Saving vs Spending $10,000: What's the Difference? | Gabi

This post is by Ben Yu, Thiel Fellow, founder of Sprayable and the digital currency Stream, which is set to be released at the end of 2017. A version of this post originally appeared on HackCreditCards.com.

I hate those posts that keep you waiting for the “secret” answer until the very end. So, there you go, there’s the answer. You can stop reading now.

But if you want to learn just how spending $10,000 versus saving $10,000 a year can save 48.7 years of your life, keep reading.

This is going to be a hands-on blog post, so grab your touchscreen, trackpad and/or keyboard and let’s get started.

First, we’re going to take a field trip over to Networthify’s Early Retirement Calculator.

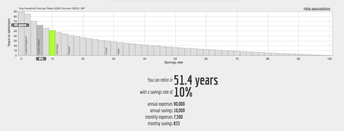

Now, we’re going to put in some play numbers. Let’s assume a current income of $100,000 to keep things simple. Then, let’s put $10,000 as our annual amount of savings, and by consequence, $90,000 as our annual amount of spending. We can keep the other numbers at their default assumptions for now.

Click crunch the numbers, and see the future of your life unfold.

Starting from today, if you pick this life path, you will be able to retire in exactly 51.4 years.

If you’re starting when you’re 20, that’s…when you’re 71 years old. Not horrible, but also not the greatest. Possibly a little later than you were expecting?

At least you can console yourself in the fact that the average American saves only 6% a year (as seen in that handy chart on the page), and will retire at 82, a full decade and change after you.

Given that average life expectancy is currently 78 years in the US, you can find deep gratitude in the fact that you’ll be alive to enjoy, statistically, a full 7 years of blissful retirement before being burned to ashes or eaten by worms or what have you. That’s far more than your fellow Americans can ask for, given that they will on average have already been dead for half a decade before getting the chance to retire. Woohoo!

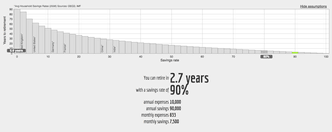

Ok. Since life is a choose your own adventure book and we’re not doomed to any one destiny, let’s flip back some pages and try a different path. Let’s say this time around, instead of saving $10,000 and spending $90,000 a year, you flip that on its head. You spend $10,000 a year, and save $90,000. Now let’s put those numbers in…and voilà:

2.7 years. That’s…48.7 years less than Life Path #1. If you start down this road when you’re 20…well, it’s not going to be a long road. You’ll be out of the rat race and free to spend the rest of your life devoted to your true calling, passion, philanthropic work, or just lying around on beaches before you’re halfway through your 20s. Before you’re even a third through your 20s, actually.

Pretty cool, no?

Ok, let me know when you’re done imagining never having to worry about money or working purely or partially for a paycheck ever again, starting in just a few years from now, and we’ll move on to some explanation.

The Secret

Ready? Great. So how is this possible? How is it that spending $10,000 versus saving $10,000 can have such a dramatic impact on your time-to-retirement, and quite literally save nearly 50 years of your life?

There’s a simple answer, and it’s the key to knowing where you stand on the path to retirement. And it’s actually a question: How many years of annual expenditure do you have saved up?

You see, financial independence is a calisthenic exercise. It doesn’t matter how much you save or spend relative to anyone else – only to yourself. All that matters is how many pushups you can do to your own financial bodyweight – and once you hit somewhere between 20-40, you’re officially financially fit.

If you spend $10,000 a year, and you have $300,000 saved up, you’re financially independent. You have 30 years of annual expenditure under your belt, and if you were to stop earning any income tomorrow and live solely off the interest from your savings, you would be just fine and dandy.

Alternatively, if you spend $90,000 a year, and you have $300,000 saved up, you are financially barely treading water. You have less than 3.5 years of annual expenditure under your belt, and if you were to stop working tomorrow, you may find yourself slowly starving to death five years out.

It’s this insight that allows us to discover that by just tweaking a few metrics on our spending and saving, we can drastically shave years off the time we must spend working before we become financially independent and free to pursue any endeavor in life with no regard to the income such an endeavor might provide us with.

The Reality

Now, to be fair, while saving $10,000 when earning $100,000 (after tax) is apparently more than most people manage and is a generous assumption, you might be thinking that only spending $10,000 a year is a little extreme.

And you would be right. It is extreme. But not because it’s not well within the realm of possibility, but rather simply by dint of the fact that no one does it. You would be an extreme outlier if you managed it. But it is possible, and if it saves you almost half a century of life on your own completely unadulterated terms, it just might be worth it, no?

If you’re interested in exploring just what such a lifestyle might look like and how you might manage this feat, I’d encourage you to explore the following two blog posts:

How I Live on $7000 Per Year, by Jacob in the San Francisco Bay Area (a notoriously expensive place to live)

The Mr Money Mustache Family’s 2014 Spending, by Mr Money Mustache, an illustrious financially responsible mustache who lives with his loving wife and son in Colorado and spends ~$8,500/year per person in his household

Both these fine individuals enjoy a quality of life and a level of happiness well beyond that of the average American. In particular, their level of happiness and life satisfaction is off the charts when compared to the average American. My hypothesis for this phenomenon is one, that they have perhaps discovered that very little of our satisfaction and happiness in life is derived from the things that money can buy. Two, perhaps not ever having to worry about money again in your life is one thing about money that can bring great joy and remove a significant source of conflict and struggle from your daily act of existence.

That said, you do not need to spend only $10,000 a year or earn $100,000 a year to reap the legion benefits of having this perspective on your finances. Too often, it’s easy for us to just fall into the general assumption that we will retire sometime in our rough 60s, and that if we just save where we can here and there and not worry about it too much, and not rack up too much debt, we should be fine. Perhaps we even know that we should be more cognizant of where we stand and where we’re going, but it’s just too overwhelming to think about now—we’re busy—and there will be plenty of time in the future to deal with it closer to the fact.

You Too Can Be A Winner

I hope it’s reassuring, then, to know that it’s not difficult, and not overwhelming, and you absolutely can get started today. All you need to know is how much you spend every year (simple: just see how much you earn, and how much you have left over at the end of the year), and how much you have saved up. Then divide the second number by the first, and see if that number is above or under 30. If it is under 30, see if it is feasible to get it above 30 doing what you are currently doing, in a timeframe that is acceptable to you. If it is, then great, you’re doing just fine and you should stop reading now and I am sorry for wasting so much of your time reading something that was entirely unnecessary for you.

If it isn’t, don’t despair. With a few tweaks here and there, very nearly anyone in America earning over $30,000 can retire well before the average person ever even begins thinking about retirement.

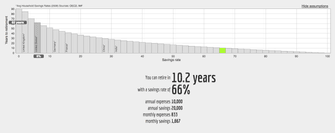

In fact, if you make just $30,000 after tax, and spend only $10,000, you’ll retire in just over 10 years. If you start when you’re 20, that’s on your 30th birthday.

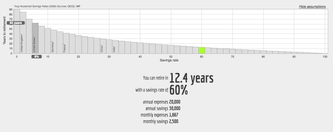

And more realistically, perhaps, if you make $50,000 after tax and spend $20,000 a year, never fear and don’t despair, you too shall be in the clear by a future quite near:

The Choice Is Yours

So, in sum: 71 or 23. It’s your choice. We do not provide financial advice. Some people enjoy slaving away for a paycheck for the rest of their lives. Some don’t. This is purely a personal choice, and there is no right or wrong. Please choose whichever option sounds most enjoyable to you personally.

But if you do wish to choose the path of ridiculously early financial independence…do know that it is indeed very possible, and very well within your grasp.

Gabi finds you a better home or car insurance for an average savings of $961/year.

It only takes 1 minute to register and connect your current insurance account.

Click on the button below to get started.